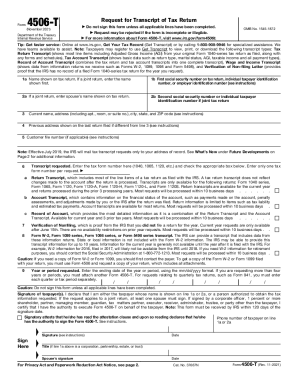

OR 150-101-043 2008 free printable template

Show details

2008 Oregon Income Tax Full Year Resident Form 40, Form 40S, Schedule WFC, and instructions Bird: Western Meadowlark Flower: Oregon Grape Animal: Beaver Fish: Chinook Salmon Tree: Douglas Dance: Square

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR 150-101-043

Edit your OR 150-101-043 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR 150-101-043 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OR 150-101-043 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OR 150-101-043. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR 150-101-043 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR 150-101-043

How to fill out OR 150-101-043

01

Begin by gathering all necessary personal information.

02

Enter your name and identification number in the designated fields.

03

Fill out your address, ensuring accuracy.

04

Provide any required financial details relevant to the form.

05

Complete sections pertaining to employment or business information, if applicable.

06

Review the form for any missing information or errors.

07

Sign and date the form at the bottom of the page.

08

Submit the form as instructed, either online or by mailing it to the appropriate address.

Who needs OR 150-101-043?

01

Individuals applying for specific governmental benefits or services.

02

Businesses seeking to comply with regulatory requirements.

03

Residents needing to update personal information with governmental agencies.

04

Applicants who must verify their identity for legal or financial purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a Form 40 Oregon resident tax return?

Use Form OR-40 if you're a full-year Oregon resident. Use Form OR-40-P if any ONE of the following is true: You're a part-year resident. You're filing jointly and one of you is a full-year Ore- gon resident and the other is a part-year resident.

How do I get a copy of my Oregon tax return?

Request online You need to be logged in to your Revenue Online account to use this option. Once you are, click on the Request photocopies link under "I want to." If you don't have an account, signing up for one is quick and easy.

What tax form do I use if I am a part-year resident in Oregon?

Part-year residents Use Form OR-40-P if any of the following are true: You're a part-year resident who isn't filing a joint return. You're married and filing a joint return, and you and your spouse are part-year Oregon residents, or one spouse is a full-year Oregon resident and the other is a part-year resident.

What is a Form 40 in taxes?

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

What is the or 40N instruction?

Form OR-40N Instructions requires you to list multiple forms of income, such as wages, interest, or alimony . We last updated the Individual Income Tax Return Instructions for Nonresident / Part-year Resident in January 2023, so this is the latest version of Form OR-40N Instructions, fully updated for tax year 2022.

What is Form 40 Oregon resident tax return?

Use Form OR-40 if you're a full-year Oregon resident. Use Form OR-40-P if any ONE of the following is true: You're a part-year resident. You're filing jointly and one of you is a full-year Ore- gon resident and the other is a part-year resident.

Do I need to file Oregon resident tax return?

Full-year resident You need to file if your gross income is more than the amount shown below for your filing status. Even if you don't have a filing requirement, you must file a return if you want to claim a refund of Oregon income tax withheld from your pay or you qualify for a refundable credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OR 150-101-043 for eSignature?

Once your OR 150-101-043 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I edit OR 150-101-043 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share OR 150-101-043 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out OR 150-101-043 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your OR 150-101-043, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is OR 150-101-043?

OR 150-101-043 is a tax form used in the state of Oregon for the purpose of reporting specific tax-related information.

Who is required to file OR 150-101-043?

Individuals and entities that engage in activities subject to Oregon's specific tax regulations are required to file OR 150-101-043.

How to fill out OR 150-101-043?

To fill out OR 150-101-043, you should follow the instructions provided on the form, including providing accurate information about your income, deductions, and any applicable tax calculations.

What is the purpose of OR 150-101-043?

The purpose of OR 150-101-043 is to collect accurate tax information from taxpayers in Oregon to ensure compliance with state tax laws.

What information must be reported on OR 150-101-043?

The information reported on OR 150-101-043 includes taxpayer identification details, income sources, deductions, credits, and any other relevant tax-related data.

Fill out your OR 150-101-043 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR 150-101-043 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.